Dreading the end of Daylight Saving Time? Trick your way into a brighter space — even when the natural light prospects are dim. Whether you

Tag: homes for sale in montana

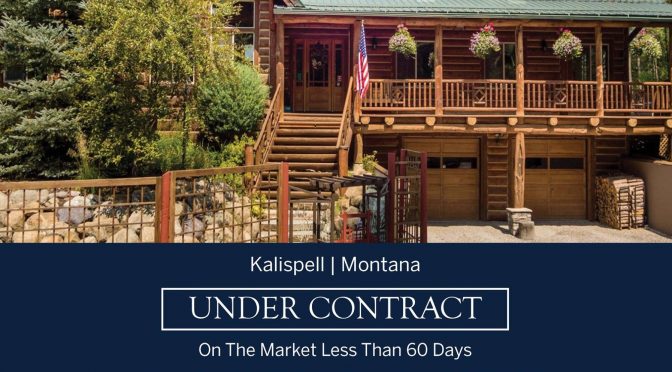

Not sure when to sell your house? If you’ve been on the fence, we’ve got good news: It’s a great market for sellers! Limited inventory

Who doesn’t love a road trip? September is known (by the locals) for being the best month to see Montana. The sky is robin’s egg

Start saving and planning for that down payment NOW! For those of you who have millennial children, I’m pretty sure that you have (more than